Uncover the dual role of biblical tax collectors as both societal outcasts and symbols of redemption, revealing a deeper spiritual message.

Who Is a Tax Collector in the Bible

In the Bible, tax collectors were both reviled and redeemed, a juxtaposition that paints a complex picture of these historical figures. You'll find that while society often viewed them as sinners and outcasts due to their roles in collecting levies for the Roman Empire, the New Testament offers a different narrative.

Characters like Matthew and Zacchaeus not only find personal transformation but also play key roles in illustrating Jesus' teachings on forgiveness and change. This intriguing contradiction invites you to explore further into how such despised individuals could become examples of spiritual renewal and redemption.

Why do you think these stories of tax collectors were important enough to be included in the biblical narrative?

Key Takeaways

- Tax collectors in the Bible are often viewed as societal outcasts due to their roles in taxation.

- Biblical stories, like Zacchaeus and Matthew, showcase tax collectors' potential for redemption and transformation.

- Jesus's interactions with tax collectors challenge societal norms and emphasize the importance of forgiveness and inclusivity.

- The portrayal of tax collectors in the Bible reflects broader themes of ethical accountability and societal justice.

Historical Background of Tax Collectors

Throughout history, tax collectors have often been perceived with disdain, serving as agents for the collection of levies that were essential for the functioning of states and empires, yet burdensome to the populace. This historical background sets the stage for understanding the varied revenue methods employed and the complex ethics surrounding taxation.

Revenue methods have evolved significantly over time. In ancient civilizations, taxation often took the form of labor or goods, a system that directly supported the state's needs, such as building infrastructure or sustaining the military. As societies became more monetized, tax collection shifted towards financial levies. This transition necessitated a more sophisticated approach to ensure compliance and fairness in tax collection. You'd find that the methods employed were as diverse as the societies themselves, ranging from fixed tributes based on land ownership to more nuanced systems that considered income, wealth, or consumption.

Taxation ethics, on the other hand, delve into the moral principles that govern the imposition and collection of taxes. At its core, the ethical debate revolves around fairness and equity. You're prompted to consider questions such as: Who bears the tax burden? Are the wealthy disproportionately advantaged? Does the tax system provide for the common good? The role of tax collectors in this ethical landscape is particularly contentious. They're tasked with enforcing the law, yet they must navigate the fine line between ensuring state revenues and not overburdening the populace.

Societal Views on Tax Collectors

Many societies, both ancient and modern, have harbored a deep-seated ambivalence towards tax collectors, viewing them as necessary agents of the state yet often vilifying them for their roles in enforcing taxation policies. This dichotomy stems from the essential function tax collectors perform in funding government operations and public services, juxtaposed against the personal financial burden their work imposes on individuals and businesses. As you delve deeper into this societal perception, it becomes clear that the contention surrounding tax collectors isn't merely a historical artifact but a reflection of ongoing ethical dilemmas and modern perceptions concerning fairness, corruption, and the role of government in personal finances.

Modern perceptions of tax collectors are shaped by the broader societal context in which they operate. In societies where taxation is seen as a fair exchange for public services and infrastructure, tax collectors may be viewed more favorably. However, in contexts where taxes are perceived as excessive or misused, tax collectors can become targets of public scorn. This tension highlights the ethical dilemmas inherent in tax collection, including debates over what constitutes a fair tax system, how to balance the needs of the state with the rights of individuals, and the ethical responsibilities of those who collect taxes.

The role of tax collectors, therefore, isn't just a matter of enforcing tax laws but also navigating the complex interplay of legal, ethical, and societal factors that influence public perceptions of their work. As agents at the intersection of government authority and individual financial obligations, tax collectors embody the perennial challenge of reconciling the collective needs of society with the personal freedoms of its members.

Biblical References to Tax Collection

You'll find that the Bible doesn't shy away from discussing the role and perception of tax collectors in society.

Through stories like Zacchaeus's transformation and interactions between Jesus and tax collectors, it presents a nuanced view of their societal position and moral considerations.

These narratives offer insights into the complexities of tax collection and its impact on both personal and community life in biblical times.

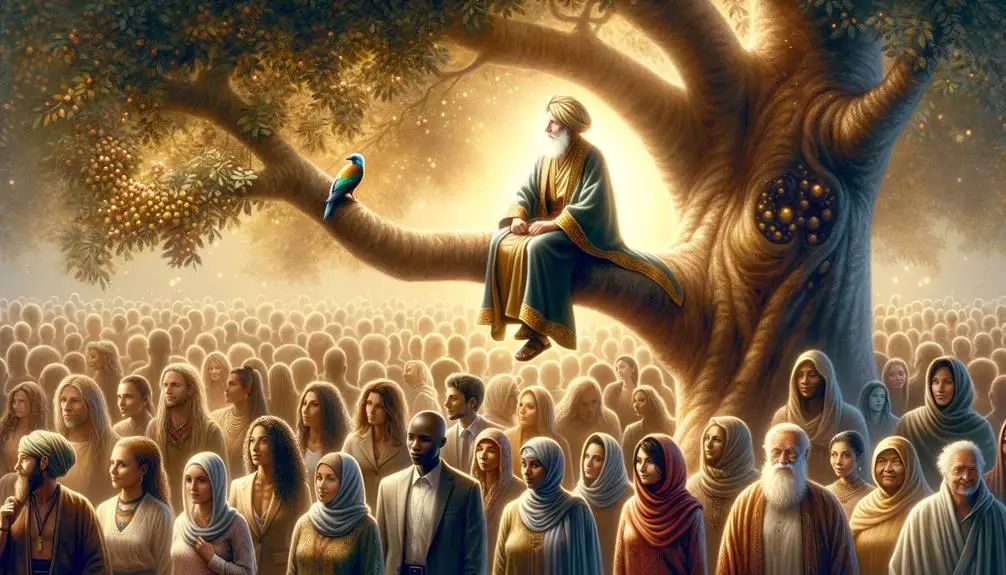

Zacchaeus's Transformation Story

In the Gospel of Luke, Zacchaeus's transformation from a reviled tax collector to a figure of redemption highlights the complex role of tax collection in biblical narratives. Desperate to see Jesus but hindered by his short stature and the disdainful crowd, Zacchaeus employs climbing techniques, ascending a sycamore tree for a better view. This action, emphasizing his determination, contrasts sharply with the crowd's reaction, which likely viewed his efforts with skepticism or mockery, given his social standing.

Zacchaeus's subsequent vow to rectify his wrongs through restitution and charity underscores a pivotal shift. His story encapsulates the tension between societal disdain for tax collectors and the potential for personal transformation, framing tax collection within a broader discourse of redemption and societal judgment.

Jesus and Tax Collectors

Throughout the New Testament, Jesus's interactions with tax collectors reveal a profound critique of, and yet compassionate approach towards, the socio-economic structures of the time. His engagement with these figures highlights significant themes:

- Tax Morality: Jesus's interactions underscore the complex morality surrounding tax collection, challenging the collectors to act justly.

- Revenue Importance: Acknowledgment of the necessary role revenue plays in society, while advocating for fairness and compassion in its collection.

- Inclusivity and Redemption: Demonstrating inclusivity, Jesus dines with tax collectors, offering them paths to redemption and societal reintegration, thus critiquing societal ostracization based on occupation.

This nuanced approach invites you to consider the balance between the need for societal revenue and the imperative of equitable, moral conduct in its collection.

The Story of Matthew

Matthew's story in the Bible exemplifies a transformative journey from a tax collector to a devoted follower of Jesus Christ, illustrating the power of redemption and forgiveness. This narrative not only highlights a personal transformation but also sheds light on the broader themes of Matthew's authorship and taxation ethics in the biblical context.

As the attributed author of the first Gospel, Matthew brings a unique perspective to the New Testament, particularly in how he addresses the ethical dilemmas surrounding taxation practices of his time. His prior occupation as a tax collector, considered by many Jews to be a position marked by betrayal and greed due to collaboration with the Roman occupiers, positions him uniquely to discuss these matters with both authority and personal insight.

Analyzing Matthew's story, one can't help but ponder the implications of his past on his writings. His firsthand experience with the societal disdain faced by tax collectors provides a backdrop against which his message of divine grace and inclusion unfolds. The Gospel according to Matthew emphasizes Jesus's teachings on love, mercy, and the importance of reaching out to the marginalized and despised, a theme undoubtedly influenced by Matthew's own experiences of exclusion and subsequent acceptance.

Moreover, Matthew's narrative invites readers to reevaluate the ethics of taxation within a religious framework, challenging them to consider the balance between lawful obedience and moral integrity. His transformation from a tax collector to an evangelist serves as a testament to the possibility of change and the power of faith to transcend one's past. Through Matthew's lens, the biblical discourse on taxation ethics transcends mere legalism, advocating for a holistic approach that harmonizes with the core Christian values of compassion and justice.

Zacchaeus' Transformation

You'll observe that Zacchaeus' transformation is a critical narrative, highlighting the profound impact of his encounter with Jesus.

This event not only catalyzes his repentance but also leads to significant acts of restitution, demonstrating a tangible change in character.

Analyzing this transformation sheds light on the broader implications of personal change within the scriptural context.

Zacchaeus' Encounter With Jesus

In the biblical narrative, Zacchaeus' transformative encounter with Jesus marks a pivotal moment in his life, demonstrating the profound impact of grace and redemption. This event unfolds with Zacchaeus employing climbing techniques to overcome his short stature and the crowd's disdain, positioning himself atop a sycamore tree. The crowd's reactions range from curiosity to judgment, highlighting societal barriers yet underscoring the inclusivity of Jesus' message.

To deepen understanding, consider the following:

- Climbing Techniques: Symbolic of overcoming personal and societal barriers.

- Crowd Reactions: Reflective of societal prejudices and the challenges of societal acceptance.

- Inclusivity of Jesus' Message: Demonstrates a universal appeal transcending societal divisions.

This encounter not only signifies personal transformation but also illustrates the breaking down of societal barriers, inviting a scholarly exploration of the themes of grace, redemption, and inclusivity.

Repentance and Restitution

Zacchaeus' transformation embodies the profound spiritual principles of repentance and restitution, illustrating their pivotal role in the journey towards redemption. This narrative not only serves a historical purpose but also offers modern parallels and ethical considerations for contemporary society.

Aspect |

Biblical Context |

Modern Parallel |

|---|---|---|

Repentance |

Zacchaeus' admission of wrongdoing |

Acknowledging one's ethical missteps |

Restitution |

Pledging to return fourfold |

Committing to rectify harm done |

Redemption |

Zacchaeus' acceptance by Jesus |

Societal reintegration after amends |

Ethical Consideration |

Zacchaeus' voluntary action |

Personal responsibility in ethical dilemmas |

These elements underscore the timeless nature of ethical accountability and the transformative power of genuine repentance and restitution in rectifying past wrongs.

Impact of Transformation

By undergoing a profound transformation, Zacchaeus not only reshaped his own destiny but also set a powerful precedent for the impact of ethical change on community dynamics. This narrative offers invaluable insights into the role of personal accountability in societal healing and growth. The story of Zacchaeus underscores three key points:

- Ethical transformations can rebuild trust and foster reconciliation within communities.

- Individuals' actions have the power to influence broader societal norms and expectations.

- Modern parallels show that personal change can inspire collective progress, emphasizing the relevance of ethical considerations in contemporary issues.

Analyzing Zacchaeus' transformation through these lenses not only deepens our understanding of biblical teachings but also highlights the timeless nature of its lessons on integrity, repentance, and the potential for redemption.

Jesus' Interaction With Tax Collectors

Jesus' engagement with tax collectors throughout the Gospels reveals a transformative approach to societal outcasts, emphasizing redemption and inclusion. His interactions aren't merely incidental; they're deliberately positioned to challenge prevailing notions of tax morality and to foster collector empathy. You observe Jesus navigating the complex social dynamics with a focus on the human element behind the tax collector's role, often vilified due to associations with extortion and collaboration with occupying forces.

By inviting Matthew, a tax collector, to become one of His disciples, Jesus sets a precedent that transcends mere acceptance. This act is a profound demonstration of trust and potential for personal transformation, effectively redefining the societal identity of tax collectors from betrayal to discipleship. This inclusion disrupts traditional barriers, suggesting that moral and spiritual renewal is accessible to all, irrespective of their past actions or societal status.

Moreover, Jesus' dining with Zacchaeus, another tax collector, further illustrates His method of engagement. Through this personal interaction, He facilitates a space for Zacchaeus to voluntarily commit to restitution and generosity, actions stemming from genuine transformation rather than external compulsion. This scenario underscores the power of empathetic engagement to instigate ethical reflection and behavioral change among tax collectors.

Analyzing these interactions, you grasp Jesus' strategic approach to challenging and reshaping societal norms. His method emphasizes personal connection, redemption, and the potential for moral rehabilitation, offering a radical departure from the exclusionary practices of His time. Through these engagements, Jesus not only elevates the social perception of tax collectors but also models a path towards a more inclusive and empathetic society.

Lessons on Forgiveness and Change

Reflecting on Jesus' interactions with tax collectors, we uncover profound lessons on forgiveness and the potential for personal change. These narratives not only offer insights into spiritual renewal but also serve as modern parallels, illustrating the timeless nature of these teachings.

By examining these accounts, we can draw several key lessons:

- Forgiveness is a Catalyst for Transformation: Tax collectors, often vilified in their societies, experienced profound personal change following their encounters with Jesus. This illustrates how forgiveness can serve as a powerful catalyst for transformation, encouraging individuals to transcend past misdeeds.

- Change Requires Humility and Openness: The willingness of tax collectors to acknowledge their faults and seek redemption highlights the importance of humility and openness in the process of change. This principle remains relevant today, emphasizing that genuine transformation begins with self-awareness and the courage to embrace change.

- Emotional Healing is Integral to Personal Growth: The interactions between Jesus and the tax collectors underscore the role of emotional healing in personal development. By offering forgiveness, Jesus facilitated a process of emotional healing, enabling these individuals to forge new identities and paths in life. This aspect of the narrative suggests that emotional healing is a critical component of forging a meaningful and fulfilling life.

These lessons, drawn from ancient texts, resonate with contemporary experiences, emphasizing the enduring relevance of forgiveness and change. They remind us that, irrespective of the era, the journey towards personal growth and redemption is both possible and profoundly transformative, offering hope and guidance for those seeking emotional healing.

Frequently Asked Questions

How Did the Role and Perception of Tax Collectors Evolve in the Period Following the New Testament Era, Particularly During the Early Christian Church Period?

After the New Testament era, your understanding of tax collectors' roles and their perception underwent significant changes.

In the early Christian church period, the conversation around taxation ethics evolved, emphasizing moral considerations in tax collection.

This shift also paved the way for the notion of collector redemption, where collectors could seek forgiveness and reform their ways.

This evolution reflects an increasing integration of Christian values into societal roles and perceptions.

Are There Any Non-Biblical Historical Documents or Records From the Roman Empire or Jewish Historians That Mention the Practices or Societal Views of Tax Collectors During Biblical Times?

You're diving into whether non-biblical sources from the Roman Empire or Jewish historians shed light on tax collector practices and their societal views during biblical times. Indeed, documents like Roman taxation records and narratives from collectors themselves offer valuable insights.

These sources, while scarce, help piece together the societal puzzle around tax collection, revealing the complexities of their roles and how communities perceived them, providing a broader, more nuanced historical context.

How Did the Jewish Religious Laws and Traditions Specifically Address the Ethics of Tax Collection and the Treatment of Tax Collectors Within the Community?

You're exploring how Jewish religious laws tackled ethical dilemmas surrounding tax collection and the resulting community ostracization of tax collectors.

These laws intricately wove societal norms with religious beliefs, often positioning tax collectors in morally ambiguous roles.

This scrutiny under religious law not only highlighted the ethical complexities of their duties but also significantly influenced their social standing, leading to widespread marginalization within their own communities.

In What Ways Have Modern Interpretations or Portrayals of Biblical Tax Collectors in Literature, Film, or Art Influenced Contemporary Understanding of Their Role and Significance?

You've likely noticed how modern interpretations, especially through cinematic stereotypes and literature adaptations, have molded our perception of biblical tax collectors. These portrayals often emphasize their greed or moral struggles, significantly influencing contemporary views on their historical roles and significance.

This trend in art and media not only shapes our understanding but also prompts a reevaluation of their societal impact and the ethical dimensions surrounding their profession in ancient contexts.

Can Parallels Be Drawn Between the Biblical Tax Collectors and Any Similar Figures or Roles in Other Ancient Cultures or Religions During the Same Period?

You're exploring if ancient tax systems and cultural comparisons can reveal parallels to biblical tax collectors in other ancient cultures or religions.

It's crucial to analyze how societies structured their tax collection and the roles individuals played within these systems.

Conclusion

In conclusion, the biblical narrative paints tax collectors not merely as societal pariahs but as emblematic figures of transformation and redemption. Through the stories of Matthew and Zacchaeus, the text underscores that even those deemed as the scum of the earth can find a path to righteousness.

Jesus' interactions with these figures illuminate a profound message: forgiveness and change are boundless, extending even to those drowning in a sea of moral bankruptcy. This analysis highlights the potent blend of societal critique and redemptive possibility within biblical teachings.

Sign up